Major market responses to Federal Reserve moves explained

Major market responses to Federal Reserve moves influence stock prices, borrowing costs, and economic growth, highlighting the importance of monitoring interest rate changes and economic indicators for informed investment strategies.

Major market responses to Federal Reserve moves shape the financial landscape significantly. Are you curious about how these shifts impact your investments? Here, we delve into the intricacies of market dynamics affected by the Fed’s decisions.

Understanding Federal Reserve’s role in markets

The Federal Reserve plays a crucial role in the U.S. economy and in global markets. Its decisions can significantly impact interest rates, inflation, and overall economic growth. Understanding this institution is essential for investors and anyone interested in the financial landscape.

The Core Functions of the Federal Reserve

Primarily, the Federal Reserve manages the country’s monetary policy. It does this by controlling the supply of money, aiming for stable prices and maximum employment. Let’s explore its main functions:

- Setting interest rates to influence borrowing and spending.

- Regulating banks to ensure the safety of deposits.

- Conducting economic research to inform policy decisions.

Additionally, the Federal Reserve acts as a lender of last resort to financial institutions during times of crisis. This role is particularly important during economic downturns when liquidity can become scarce. In such scenarios, the Fed provides essential support to stabilize the financial system.

The Impact on Markets

When the Fed alters interest rates, it sends ripples through the financial markets. Changes can lead to fluctuations in stock prices, bond yields, and even currency values. Investors closely monitor the Federal Reserve’s announcements for clues about future monetary policy.

For example, a rate hike typically signals a strengthening economy, which can lead to higher stock prices. Conversely, a rate cut may indicate an effort to boost growth during a slowdown. This relationship between Fed policies and market responses is a key area of focus for many economists and investors.

Understanding how decisions from the Federal Reserve influence financial markets helps investors make informed choices. By keeping an eye on the Fed’s actions and statements, investors can better anticipate market trends and adjust their strategies accordingly.

Key market indicators impacted by Fed decisions

Understanding the key market indicators impacted by the Federal Reserve decisions is essential for investors. These indicators provide insight into the economic health and are closely monitored during times of policy changes.

Interest Rates

One of the most significant indicators is the interest rate. The Fed’s adjustments influence borrowing costs for consumers and businesses. When rates are low, it encourages spending and investment. Conversely, higher rates can slow down economic activity.

- Lower rates often lead to increased consumer confidence.

- Higher rates may cool down a booming economy.

- Shifts in rates can affect the housing market significantly.

Another important metric is inflation. The Fed’s aim is to maintain a stable inflation rate, which impacts purchasing power and economic growth. A moderate level of inflation is healthy, but too much can lead to negative consequences.

Stock Market Performance

The stock market is also highly sensitive to the Fed’s decisions. Investors react to changes in interest rates, often leading to fluctuations in stock prices. When the Fed signals a rate increase, stocks might drop as borrowing costs rise, affecting corporate profits.

Similarly, bond prices are influenced as well. When interest rates rise, the existing bonds with lower rates become less attractive, causing their prices to fall. Understanding these dynamics helps investors make informed decisions.

Finally, employment rates are a crucial indicator of overall economic health. The Fed’s policies aim to foster an environment for job growth. A healthy job market often leads to increased consumer spending, which boosts the economy.

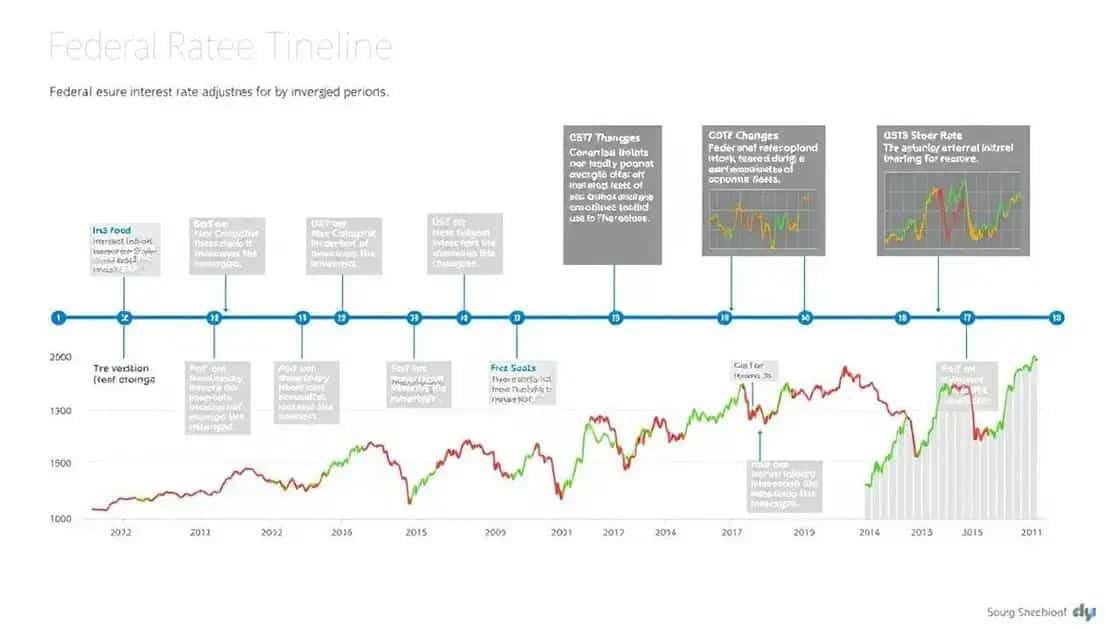

Historical market responses to rate changes

Examining the historical market responses to rate changes by the Federal Reserve can offer valuable insights. Over the years, the market has reacted in various ways depending on the context of each decision.

Past Rate Hikes and Their Effects

When the Fed raises interest rates, it often signals confidence in the economy. However, the immediate market reaction can be negative. Investors may fear that higher borrowing costs will slow down growth. Historical data shows that during past hikes, stocks typically dipped before recovering as the economy adjusted.

- In 2004, for example, the Fed raised rates multiple times.

- The stock market initially fell but rebounded later as the economy expanded.

- Investors seemed to adjust to the new normal once the hikes were digested.

Another key instance was in 1994. The Fed increased rates several times within the year. This approach led to notable volatility in the stock market, emphasizing how sensitive markets can be to such shifts.

Rate Cuts and Market Flourishing

Conversely, when the Fed lowers rates, it usually aims to stimulate economic activity. The historical responses to rate cuts have often been more favorable. For instance, during the financial crisis of 2008, the Fed slashed rates to nearly zero. The stock market initially struggled but eventually experienced substantial recoveries as liquidity improved.

The impact on consumer spending and business investment was pronounced, demonstrating the importance of interest rates in shaping economic behavior.

Trends in bond markets also reveal patterns of reaction to Fed decisions. Rate cuts tend to lead to higher bond prices, as existing bonds with higher rates become more attractive to investors. Observing these historical trends helps investors navigate future decisions.

Investors’ strategies during Fed announcements

Understanding investors’ strategies during Fed announcements is crucial for navigating market volatility. Investors often adjust their approaches based on anticipated changes in monetary policy.

Pre-Announcement Positioning

Before the Fed makes any announcements, many investors will try to predict the outcome. This prediction phase can lead to market fluctuations as traders react to rumors or economic data released prior to the meeting. Anticipating decisions can impact stock prices.

- Some investors may choose to buy stocks they expect will benefit from rate cuts.

- Conversely, others might sell off riskier assets before a potential rate hike.

- Monitoring analyst reports and economic indicators is essential for making informed predictions.

This strategy is known as “positioning.” By understanding the market sentiment ahead of time, investors aim to maximize their gains or minimize losses.

Reacting to the Announcement

Once the Fed announces its decision, immediate reactions can be intense. Investors often use quick trades to capitalize on initial market movements. For instance, a surprise in interest rate changes can lead to significant market shifts.

Some investors might employ algorithmic trading strategies, which allow for rapid execution of trades based on pre-set conditions. This can help them capture short-term price movements influenced by the Fed’s decisions.

Additionally, watching the Fed’s language and future guidance offers signals that can shape subsequent investment strategies. If the Fed hints at more rate changes in the future, savvy investors may adjust their portfolios accordingly.

Staying informed about not only the decision but also the rationale behind it provides investors with a competitive edge. Understanding both the immediate and long-term implications of Fed announcements is vital.

In recent years, many investors have also considered diversifying their portfolios as a hedge against volatility. This can include moving funds into safer assets like bonds or commodities during uncertain periods.

Predictions for future Fed actions and market reactions

Looking ahead, understanding predictions for future Fed actions and their potential market reactions is crucial for savvy investors. The Federal Reserve’s decisions are often shaped by economic indicators, and these can provide clues about future moves.

Economic Indicators to Watch

Investors should keep an eye on several key economic indicators. These can include employment rates, inflation levels, and GDP growth. If inflation rises significantly, for example, the Fed may respond by increasing interest rates more aggressively.

- The Consumer Price Index (CPI) is a key measure of inflation.

- Unemployment claims can indicate the health of the labor market.

- GDP growth rates show how quickly the economy is expanding.

Monitoring these indicators helps investors anticipate how the Fed might respond in future meetings.

Market Reactions to Fed Predictions

Market reactions can vary based on the expectations set by the Fed’s communications. If the Fed signals a more hawkish stance, meaning they are focused on raising rates, stock prices may drop as borrowing costs rise. Conversely, if they indicate a dovish stance, or a preference for lower rates, stock prices may rise due to increased investor confidence.

Analyzing historical responses to Fed actions can also provide insight into potential future moves. During periods of uncertainty, such as economic downturns, the Fed tends to lower rates to stimulate growth. On the other hand, when the economy is robust, they might raise rates to prevent overheating.

Understanding these dynamics allows investors to better prepare for the potential volatility that can arise from Fed decisions. It’s also wise for investors to diversify their portfolios in anticipation of market shifts, ensuring they are protected against sudden changes in monetary policy.

FAQ – Frequently Asked Questions about Federal Reserve Actions and Market Reactions

How do Federal Reserve actions affect stock prices?

Federal Reserve actions, such as interest rate changes, directly influence borrowing costs, which can lead to fluctuations in stock prices as investors react.

What should investors monitor during Fed announcements?

Investors should watch key economic indicators like inflation rates, unemployment data, and guidance from the Fed to anticipate market reactions.

What strategies can investors use to prepare for rate changes?

Investors may adjust their portfolios by diversifying assets to mitigate risks and positioning investments based on expected Fed actions.

How do historical responses to the Fed’s actions help investors?

Studying past market responses to the Fed’s rate changes can provide insights and help investors make informed decisions during future Fed announcements.